Digital Legacy: Managing Online Accounts After Death

1. Introduction – The Digital Life That Outlives Us

In today’s connected world, death doesn’t mean disappearance. Our digital lives, such as emails, photos, social media profiles, and online subscriptions, can outlast us by decades if not properly managed. For families, these accounts often hold both sentimental and sensitive information, from cherished memories to financial access points.

A well-organized digital legacy plan ensures your loved ones can manage or close your accounts responsibly and in accordance with your wishes. Without one, relatives may struggle to access critical records, protect your privacy, or prevent posthumous identity theft.

Estate planning used to mean dividing physical assets like homes, cars, and heirlooms. Today, it must also include passwords, online accounts, cloud storage, and even cryptocurrency keys.

This guide provides a framework for managing digital assets before and after death, giving families peace of mind and protecting the dignity of your online presence.

For a broader overview of digital footprint management, see Digital Identity Protection and PII Removal: Why It’s Now a Family Essential.

2. What Is a Digital Legacy and Why It Matters

A digital legacy is the record of your online existence: every account, file, and digital trace that persists after you’re gone. It includes:

- Personal communications: emails, text messages, and chat histories

- Social and creative accounts: Facebook, Instagram, YouTube, art portfolios, blogs, etc.

- Financial and utility accounts: online banking, bill-pay portals, subscription services

- Cloud and storage services: Google Drive, iCloud, Dropbox, password vaults

- Digital assets: cryptocurrency wallets, NFTs, and domain names

These assets are not merely technical; they’re emotional, legal, and financial. Managing them ensures that your family can preserve what’s meaningful while protecting what’s private.

Unattended accounts are vulnerable to hacking, impersonation, or fraud. In fact, according to the IRS, more than 2.5 million identities are used fraudulently each year after the person’s death .

For context on how exposed data creates long-term risks, read 7 Ways Your Personal Information Gets Exposed Online.

3. Taking Inventory of Your Digital Accounts

The first step in planning your digital legacy is taking inventory to know what exists. This doesn’t require special software, but it requires thoroughness.

List All Online Accounts

Include every platform where you have credentials: email, cloud storage, social media, streaming services, and online banking. Don’t forget memberships, utilities, or loyalty programs linked to your credit cards

Categorize by Function and Value

Group accounts into categories: personal, financial, business, creative, and legacy content, such as photos, videos, and writing. This helps your executor prioritize what to close, transfer, or preserve.

Document Access Credentials Securely

Use a password manager with a “legacy access” or “emergency contact” feature (see next section). Avoid written lists stored in drawers or emails; these are easily lost or compromised.

Store the Inventory Safely

Save the list (or the vault) in an encrypted file, or share via a secure estate-planning platform such as Proof of Life.

4. Using Password Vaults for Legacy Access

Modern password managers offer digital inheritance tools, allowing you to pre-authorize access to your accounts in case of death or incapacity

Legacy Features in Popular Password Managers

- Proof of Life: Browser extension lets you auto-fill saved credentials while browsing.

- 1Password: Allows designation of an “Emergency Kit” with vault access credentials.

- LastPass: Lets you name trusted contacts who can access your vault after verification.

- Bitwarden & Dashlane: Support encrypted export options for executors.

“The average user has 170 digital accounts.”

Setting Up Secure Access

Choose a digital executor, someone tech-savvy and trustworthy. Share access instructions through encrypted vault-sharing features or via your attorney. Never email master passwords.

Why This Matters

Without access, surviving family members may be locked out of vital documents such as tax records, insurance policies, or online business accounts. A password vault inheritance plan avoids emotional distress and time-consuming recovery requests.

To explore ongoing family security routines beyond estate planning, see Protecting Your Family from Identity Theft: Best Practices.

5. Account Closure and Memorialization Procedures

Every major online platform has its own approach to handling deceased users’ accounts. Understanding these in advance ensures a smoother transition

Social Media Accounts

- Facebook: Offers Memorialization (profile remains visible, marked as “Remembering”) or Deletion (per user’s will or legacy contact choice).

- Instagram: Similar to Facebook, allowing memorialization or permanent removal.

- LinkedIn: Allows verified relatives to request account closure by submitting documentation

Email and Cloud Services

- Google’s Inactive Account Manager lets users specify trusted contacts who can download data or delete the account after a set period of inactivity.

- Apple’s Digital Legacy Program provides legacy contacts with access keys to iCloud data upon presentation of a death certificate and Apple ID.

Subscription and Financial Accounts

Cancel recurring services (Netflix, Amazon, insurance apps) promptly to prevent ongoing charges or unauthorized access. Most platforms respond quickly to formal executor requests.

Proactive setup ensures your family won’t have to struggle with legal paperwork during an already difficult time.

6. Legal and Estate Planning Integration

Your digital legacy plan should be part of your broader estate planning documents, not an informal side list.

Include Digital Assets in Your Will

List your digital executor by name, specifying what data they can access and whether accounts should be deleted or preserved. Avoid placing passwords directly in the will; it becomes a public record after probate.

Coordinate with Your Attorney or Estate Planner

Ensure your will, trust, and power of attorney authorize digital access under relevant laws such as the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA), adopted in most U.S. states.

Use Secure Document Vaults

Platforms like Proof of Life let you store wills, passwords, and directives together, ensuring your executor can access everything efficiently.

For peace-of-mind benefits of getting this right, see The Psychology of Peace of Mind

7. Avoiding Common Pitfalls

- Neglecting updates: Review your digital inventory annually or after major life changes.

- Relying on printed lists: Paper records are risky; encryption and password managers are safer.

- Assuming family access: Without prearranged consent, most companies deny relatives entry to accounts, citing privacy laws.

- Overlooking joint accounts: Clarify ownership of shared cloud folders or digital business assets.

- Ignoring sentimental value: Preserve photos, creative works, or social posts that hold family meaning before deleting accounts.

8. Conclusion – Preserving Dignity, Reducing Burden

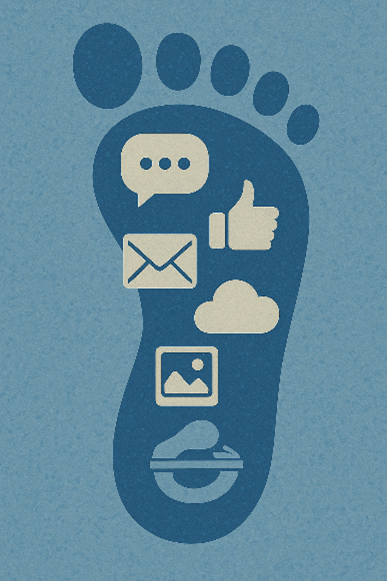

Digital legacy planning is an act of kindness as much as it is one of organization. It spares your family the pain of uncertainty and the frustration of inaccessible memories or vital documents. More importantly, it protects your posthumous privacy, ensuring your identity isn’t abused after death.

Think of it as passing down not only possessions, but peace of mind. With a structured plan, inventory, secure access, and clear directives, you can make your digital footprint manageable, meaningful, and safe for those you love.

For a complete picture of how digital estate planning fits within the broader strategy of identity protection and PII removal, return to Digital Identity Protection and PII Removal: Why It’s Now a Family Essential.

Ready to Secure Your Family's Future?

Join thousands of families who trust Proof of Life to manage their critical assets, documents, and legacy.

No Credit Card Required